A fixed-rate mortgage has a rate of interest that continues to be the same throughout the life of your funding. This is a terrific alternative for those who like consistency as well as simplicity while budgeting, as the monthly payment will never ever change. These kinds of finances are typically built in 15-year fixed-rate fundings or 30-year fixed-rate financings. That's why several Get more info homebuyers go with taken care of rates to give assurance that their rate of interest and monthly payments won't change. Amortgage is a kind of finance where property is made use of as security. A mortgage is usually used to fund your house or a financial investment property so you do not require to pay the entire quantity upfront.

The traditional quantity is 20 percent of the getting price, but it's feasible to discover mortgages that call for just 3 to 5 percent. The more money you put down, though, the less you need to fund-- and also the lower your regular monthly repayment will certainly be. If the real estate market drops and your house declines, you could wind up with a mortgage equilibrium above the value of your residence. This is called being "underwater," and also it can place you in a circumstance where you have to pay down the car loan equilibrium to offer your house considering that the loan balance is more than your house is worth.

We're the Customer Financial Security Bureau, a united state government firm that makes certain banks, lending institutions, as well as various other financial companies treat you rather. Make extra settlements whenever feasible to help reduce your mortgage principal. Home mortgage calculator This provides you an overview to how much you would certainly pay every month on a mortgage.

- The part of the payment that goes to interest doesn't lower your balance or develop your Find more info equity.

- If your present employment agreement results from end after a specific period of time, or after a specific piece of work is full, you are likely on a fixed term contract.

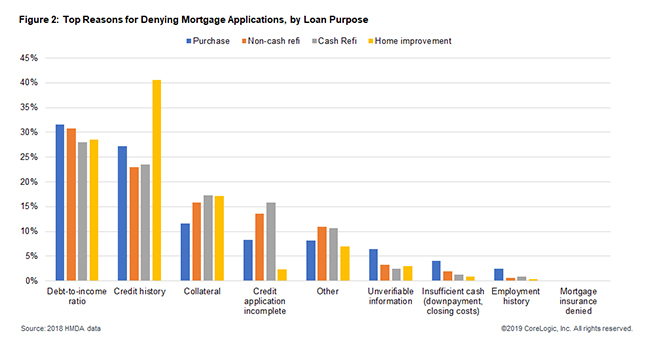

- An excellent credit report can have a positive influence on the probability of an application being approved.

- Make sure you understand the settlement choices after the forbearance duration ends.

- A second debtor can help you qualify for a mortgage by increasing your complete earnings or enhancing your consolidated credit history.

When you get a home mortgage, the home mortgage lending institution pays for your home upfront. In exchange, you settle the cash you've borrowed based upon the agreed-upon lending terms, plus rate of interest. In the meanwhile, the lending institution holds the action to the home as collateral until the mortgage is totally repaid. This indicates that you will not fully have the home complimentary and also clear till your last settlement is made.

Flexible Rate Home Loans

When you sign the funding documents, you agree on equiant financial timeshare a rates of interest and that price never alters. This is the best kind of loan if interest rates are low when you obtain a mortgage. Your rates of interest and month-to-month repayment quantity will alter over time with a flexible price home mortgage. You'll usually begin with a set rate for a few years that's a little bit lower than the ordinary set rate deal being used at the time.

What Is A Home Loan As Well As Exactly How Do I Get One?

Home mortgage are only provided to those who have adequate possessions as well as earnings relative to their financial obligations to practically bring the value of a home gradually. An individual's credit rating is likewise reviewed when deciding to expand a home loan. The rate of interest on the home loan additionally varies, with riskier customers getting greater rate of interest.

Are There Any Kind Of Other Costs Or Prices Connected With Home Mortgages?

Having a home loan in good standing on your credit scores report enhances your credit score. That credit history identifies the interest rate you are offered on various other credit score items, such as vehicle loan and also credit cards. This means that the price will certainly not change for the entire regard to the mortgage-- generally 15 or 30 years-- also if interest rates increase or fall in the future.

You should satisfy a funding program's details revenue and credit report requirements to get a home loan. A number of kinds of mortgage programs are readily available to satisfy different borrower requirements. This is likewise the time when the loan provider will dig a little deeper into your funds, running a tough credit report check to enable them to decide whether to approve your home mortgage application. Once you have actually discovered your home you intend to purchase and had actually an offer accepted, it's time to make an application for your mortgage. Whether you're buying alone or with a companion, attempt establishing a regular monthly conserving budget to develop your down payment fund.

If you have bad credit score, it's tougher to obtain a home mortgage in the UK. In this instance, your ideal choice is to invest a long time enhancing your credit rating. Nonetheless, there are lenders who offer what are referred to as negative credit scores home mortgages. These are usually supplied at sub-prime prices where you need to pay a deposit of at least 25% (often 30-- 35%). The UK home mortgage system considers each consumer's situations as unique.