When attempting to get a home mortgage with bad credit history, lots of people think that if they maintain looking for money they will at some point locate a business who will certainly approve them. If you're unsure whether your credit report is high enough, you can request a mortgage Arrangement in Principle. A lending institution will perform a soft credit scores check to comprehend what your rating is. This check will certainly appear on your credit history documents but is not visible to various other lending institutions, so also if you're decreased it will not impact your ability to look for a mortgage with a different lender. Your credit history ranking is one of the initial things a lender will check when you look for a home mortgage.

- If you presently have a government-backed finance, you might be in good luck.

- We will consider your circumstance as well as place your information with one of the most ideal lending institution.

- If you've paid your rental fee, utilities, or various other expenses promptly, attempt to get them included.

- Because of this, you may favor to wait until any type of defaults or other unfavorable credit score has disappeared from your credit history file prior to looking for a mortgage.

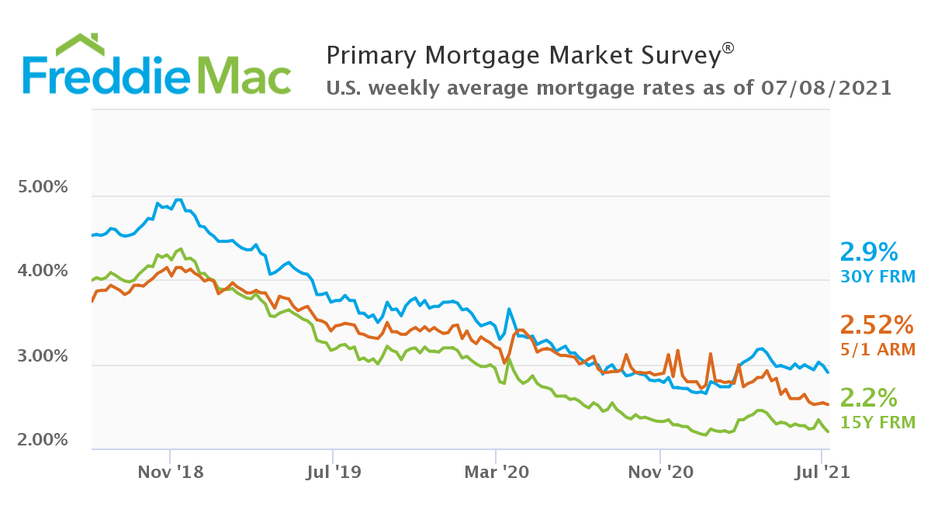

- Lenders consider factors such as the prime price to determine their prices.

A high rating sends out all the appropriate signals, while a reduced credit report, often described as "bad credit," can maintain you from getting approved. When it pertains to buying a residence, a poor credit rating typically drops below 620. In many cases, it will certainly be far better to wait until your credit rating has improved so you can access extra budget-friendly mortgage deals. A great mortgage broker will be able to recommend you on what home loan offers you're most likely to be accepted for or whether you're much better off waiting. On your credit scores documents, nonetheless, both IVAs and financial debt management plans are normally recorded as a series of defaults.

Our content group gets no straight payment from marketers, as well as our content is completely fact-checked to guarantee precision. So, whether you read an article wesley timeshare exit or an evaluation, you can rely on that you're obtaining legitimate and also reputable information. The offers that show up on this website are from companies that compensate us.

As we are entire of market loan providers we aren't linked to a panel of lenders, giving us the possibility to source your cost of a timeshare home mortgage from both professional lending institutions for bad credit history and high road lending institutions. We work with several of the most effective home loan loan providers for poor credit rating applicants, helping get you a lot with several of the very best home mortgage providers for bad credit. When your situations are extra difficult you typically locate that you assume you've found the best offer, only to discover additionally down the line that you are not eligible. In addition to being infuriating, with time usually being important throughout a residential property acquisition, delays can indicate that you lose the house that you were readied to buy.

Inspect Your Credit History

Obtain independent recommendations, a no commitment quote and also an immediate decision with our professional lending companions at Chartwell Funding. Do not let less-than-sterling credit score make you give up your dream of homeownership prior to you begin. The normal minimum is three years after a foreclosure, but even right here that can be decreased to a single year if you can reveal extenuating situations, like a momentary task loss or clinical crisis. The Financial Conduct Authority do not regulate most types of Buy to Let Mortgage Advice. As we're totally independent as well as unbiased our focus is only on locating the most effective choice for you. Our team will certainly give high quality recommendations based upon your personal circumstances, discovering a particular product suited to you.

Can I Get A Home Loan If My Partner Has Bad Credit Scores?

This is when you may intend to begin to seek an expert who can offer you specialist bad credit scores home mortgage suggestions. Getting a home loan when you have negative credit scores can be challenging, specifically if you have poor credit history, defaults, region court judgements, home loan financial obligations or private volunteer arrangements. In spite of these factors though, it's possible to obtain a bad debt mortgage. Numerous negative debt home mortgage loan providers supply very quick turn-around times, typically within a few days. As an example, Alpine Credits and TurnedAway both supply 24-hour approvals. You could also get your negative credit history mortgage approved on the same day with some loan providers.

For more information concerning exactly how these job, read our guide to the different sorts of home mortgages. Yes, it's usually possible to obtain a home loan with a poor credit rating, although your options may be Click here to find out more limited. You can still potentiallyget a joint mortgage if your partner has an IVA. The procedure for safeguarding this finance with negative debt coincides as making an application for any other sort of building finance under these conditions.